Press Release

Griffon Corporation Announces First Quarter Operating Results

Diluted EPS of $.07 in 1Q 2009 versus $.04 loss in 1Q 2008

Segment adjusted EBITDA of $17.0 million

JERICHO, NEW YORK, February 4, 2009 – Griffon Corporation (NYSE:GFF) today reported operating results for the first quarter ended December 31, 2008.

First Quarter of Fiscal 2009

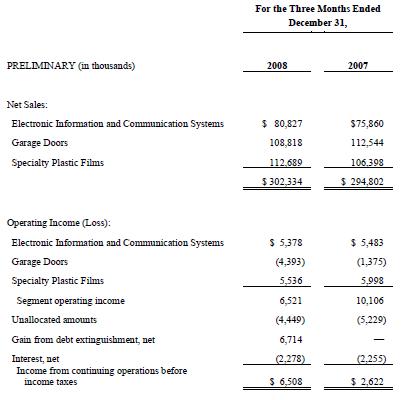

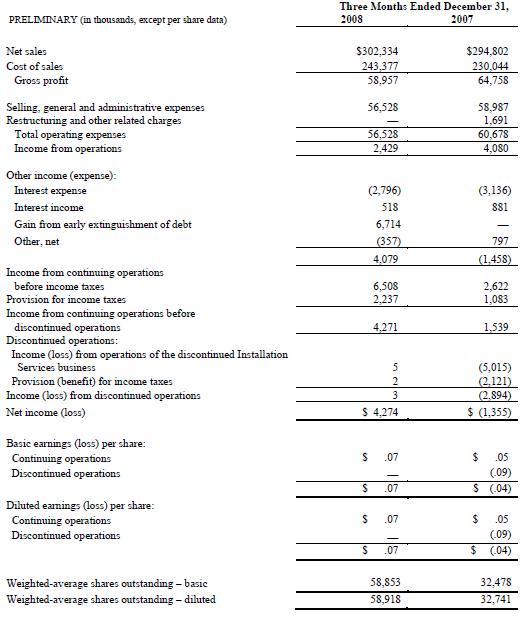

Net sales from continuing operations for the first quarter of fiscal 2009 were $302.3 million, compared to $294.8 million in the first quarter of fiscal 2008. Income from continuing operations for the first quarter was $4.3 million, or $.07 per diluted share, compared to $1.5 million, or $.05 per diluted share, last year. Results from discontinued operations for the first quarter were break-even, or nil per diluted share, compared to a loss of $2.9 million, or $.09 per diluted share, last year. Net income for the quarter was $4.3 million, or $.07 per diluted share, compared to a net loss of $1.4 million, or $.04 per diluted share, last year.

In the first quarter of fiscal 2009, the Company recorded a non-cash, pre-tax gain from debt extinguishment of $6.7 million, net of a proportionate write-off of deferred financing costs, associated with the October 2008 purchase of $35.5 million face value of its outstanding 4% convertible notes from certain note holders for $28.4 million.

The Company’s segment adjusted EBITDA for the first quarter of 2009 was $17.0 million compared to $21.8 million in 2008. Segment adjusted EBITDA is defined as operating income excluding allocations of corporate overhead, interest, taxes, depreciation and amortization, restructuring charges, goodwill charges and the impact of debt extinguishment.

As a result of the downturn in the residential housing market, in fiscal 2008, the Company exited substantially all of the operating activities of its Installation Services segment. Operating results of substantially all of the Installation Services segment have been reported as discontinued operations in the condensed consolidated financial statements for all periods presented herein, and the Installation Services segment is excluded from segment reporting. The Company is winding down remaining disposal activities in the first half of fiscal 2009 and does not expect to incur significant expenses in the future.

Telephonics Results

For the quarter ended December 31, 2008, Telephonics generated sales of $80.8 million, a 6.5% increase from the first quarter of fiscal 2008.

The sales increase was primarily attributable to growth in the Radar Systems Division driven by increases in the Lamps MMR and ARPDD programs. Last year’s first quarter sales were favorably impacted by contracts with the Syracuse Research Corporation (SRC) that were winding down in the latter part of fiscal 2007. Excluding the prior-period sales related to the SRC contracts, core business sales grew by approximately $9.4 million, or 13%. However, operating income decreased $.1 million as a result of decreased gross margin performance attributable to program mix.

Clopay Garage Doors Results

For the quarter ended December 31, 2008, the Company’s Garage Doors segment generated sales of $108.8 million, a 3.3% decrease from the first quarter of fiscal 2008. Garage Doors’ sales continued to be impacted by weakness in the residential housing and credit markets.

The Garage Doors sales decline was principally due to reduced unit volume, offset partially by higher selling prices to pass through increased material costs and product mix.

Operating loss of the Garage Doors segment increased by approximately $3.0 million compared to last year, primarily as a result of reduced sales volume and associated plant absorption loss, as well as an increased mix of certain higher-priced, but lower-margin, commercial products. The prior-year period was affected by restructuring charges of approximately $1.7 million.

Clopay Specialty Plastic Films Results

For the quarter ended December 31, 2008, the Company’s Specialty Plastic Films segment generated sales of $112.7 million, a 5.9% increase from the first quarter of fiscal 2008.

Specialty Plastic Films achieved higher sales principally due to a favorable product mix in North America and the impact of increased selling prices to pass through increased resin costs, partially offset by the unfavorable impact of exchange rates on translated foreign sales. Operating income decreased by $.5 million as the favorable contribution to gross margin from the pass through of resin costs was more than offset by an unfavorable product mix and foreign exchange translation.

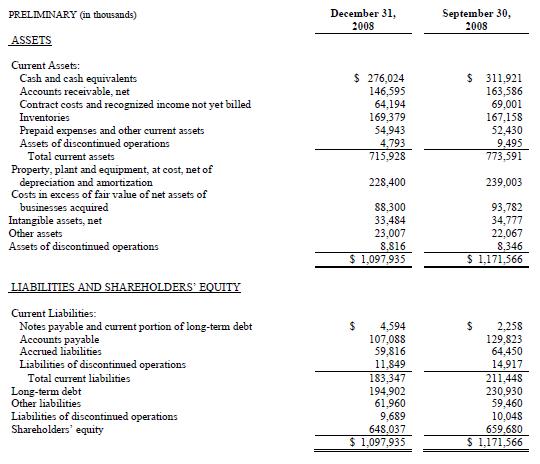

Balance Sheet and Capital Expenditures

In September 2008, the Company substantially strengthened its balance sheet by raising $241.3 million in gross proceeds from the sale of its common stock. The transaction was effected through a common stock rights offering, along with an investment by GS Direct, L.L.C., an affiliate of Goldman Sachs. An additional $5.3 million of rights offering proceeds were received in October 2008. The Company intends to use the proceeds for general corporate purposes and to fund its growth.

The Company’s total cash and cash equivalents balance at December 31, 2008 was $276.0 million. Total debt outstanding at December 31, 2008 was $199.5 million, including $94.5 million of convertible notes. Capital expenditures were $4.8 million during the first quarter of fiscal 2009.

Conference Call Information

The Company will hold a conference call to discuss its results today, February 4, 2009, at 4:15 PM EST. The conference call can be accessed by dialing 1-800-322-9079 (U.S. participants) or 1-973-582-2717 (International participants). Callers should ask to be connected to Griffon Corporation’s first quarter fiscal 2009 teleconference and provide the conference ID number 83067804. A replay of the call will be available from February 4, 2009 at 7:30 PM EST by dialing 1-800-642-1687 (U.S.) or 1-706-645-9291 (International). The replay access code is 83067804. The replay will be available through February 18, 2009.

Forward-looking Statements

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: All statements other than statements of historical fact included in this release, including without limitation statements regarding the Company’s financial position, business strategy and the plans and objectives of the Company’s management for future operations, are forward-looking statements. When used in this release, words such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors, including but not limited to, business, financial market and economic conditions, including, but not limited to, the credit market, the housing market, results of integrating acquired businesses into existing operations, the results of the Company’s restructuring and disposal efforts, competitive factors and pricing pressures for resin and steel, and capacity and supply constraints. Such statements reflect the views of the Company with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to the operations, results of operations, growth strategy and liquidity of the Company as previously disclosed in the Company’s SEC filings. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company does not undertake to release publicly any revisions to these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated events.

About Griffon Corporation

Griffon Corporation, headquartered in Jericho, New York, is a diversified holding Company consisting of three distinct business segments: Electronic Information and Communication Systems, through Telephonics Corporation; Garage Doors, through Clopay Building Products Company; and Specialty Plastic Films, through Clopay Plastic Products Company.

- Telephonics Corporation’s high-technology engineering and manufacturing capabilities provide integrated information, communication and sensor system solutions to military and commercial markets worldwide.

- Clopay Building Products Company is a leading manufacturer and marketer of residential, commercial and industrial garage doors to professional installing dealers and major home center retail chains.

- Clopay Plastic Products Company is an international leader in the development and production of embossed, laminated and printed specialty plastic films used in a variety of hygienic, health-care and industrial markets.

For more information on the Company and its operating subsidiaries, please see the Company's website at www.griffoncorp.com.

GRIFFON CORPORATION AND SUBSIDIARIES

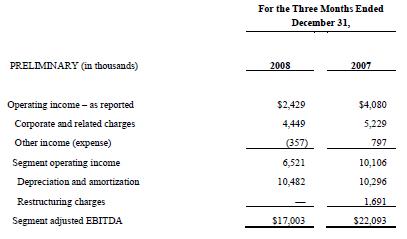

OPERATING HIGHLIGHTS

(Unaudited)

GRIFFON CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

GRIFFON CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

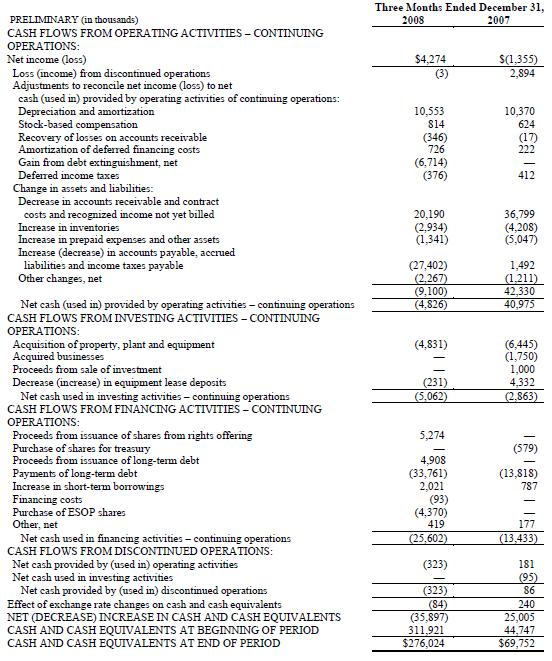

GRIFFON CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

GRIFFON CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES

SEGMENT OPERATING INCOME AND SEGMENT ADJUSTED EBITDA

(Unaudited)

The following is a reconciliation of operating income, which is a GAAP measure of our operating results, to segment operating income and segment adjusted EBITDA. Management believes that the presentation of segment operating income and segment adjusted EBITDA is appropriate to provide additional information about the Company’s reportable segments. Segment operating income and segment adjusted EBITDA are not presentations made in accordance with GAAP, are not measures of financial performance or condition, liquidity or profitability of the Company, and should not be considered as an alternative to (1) net income, operating income or any other performance measures determined in accordance with GAAP or (2) operating cash flows determined in accordance with GAAP. Additionally, segment operating income and segment adjusted EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do not consider certain cash requirements such as interest payments, tax payments, capital expenditures and debt service requirements.